- The DTC Times

- Posts

- 2026 CTV Playbook: Don't get F*ed by Fraud

2026 CTV Playbook: Don't get F*ed by Fraud

Fake screens, spoofed devices, and how operators are protecting their budgets.

Leveraging CTV to turn verified attention into measurable growth

Why the fastest-growing ad channel is also the least trusted, and how operators are fixing it with verified data

If you're running a seven or eight-figure DTC brand, you're likely exploring new channels for efficient reach. Paid channels still work, but scaling them gets more expensive every quarter.

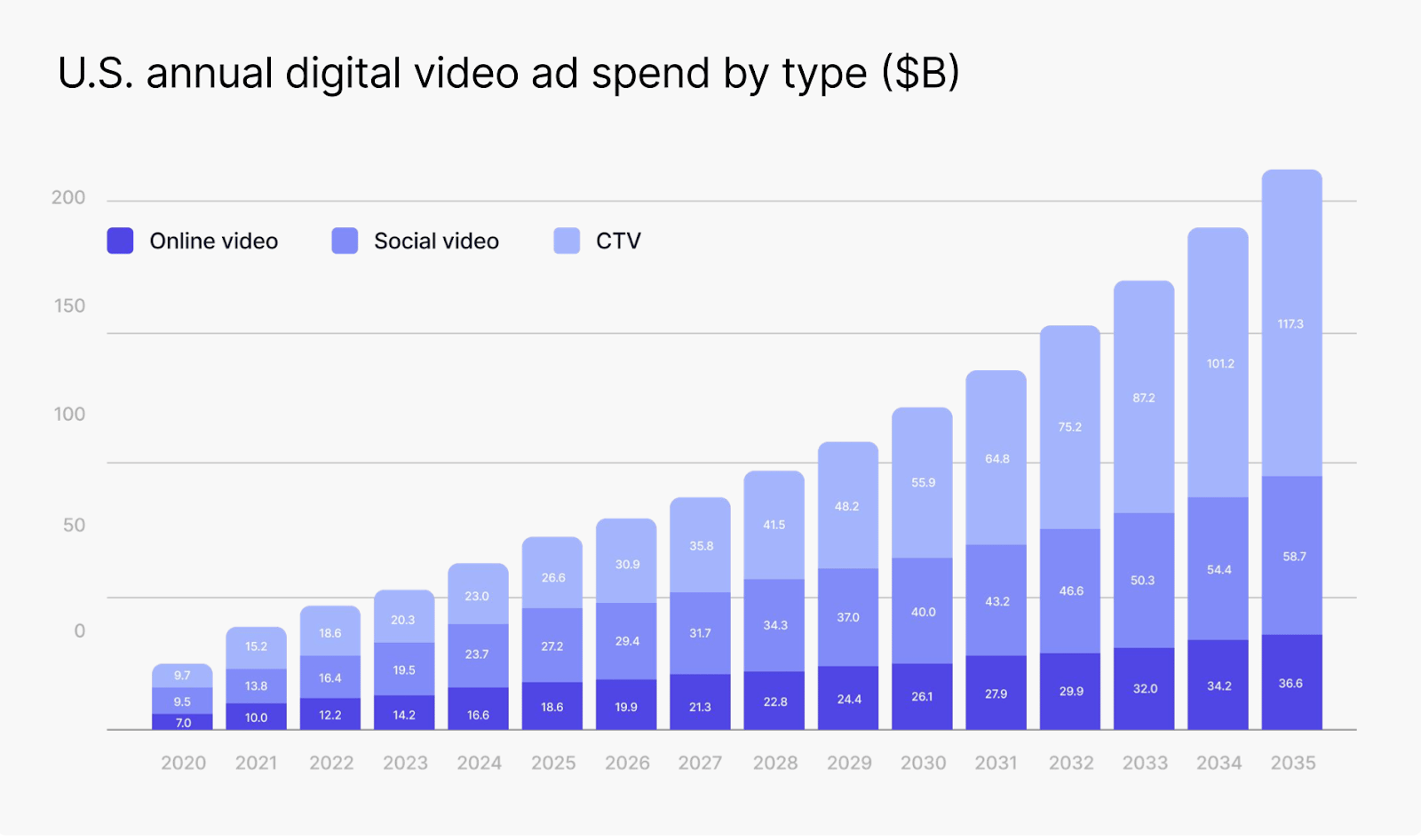

Connected TV has emerged as the next frontier. It's now a $30 billion channel growing at 13% year-over-year, combining TV-level attention with digital-style targeting and measurement.

But there's a problem most operators don't talk about: CTV's infrastructure has serious verification issues that most operators underestimate.

Today, we're doing a deep dive on Vibe's 2026 CTV Performance Playbook.

A comprehensive resource that breaks down how to turn CTV from a vanity play into a measurable profit channel.

We're pulling out what’s broken, what’s fixable, and how operators are turning CTV into real, measurable performance.

By the end of this newsletter, you’ll know how to evaluate CTV partners, avoid the most common sources of wasted spend, and build a verification-led performance strategy that scales with confidence.

Today:

Macro: The $30B paradox: a boom built on broken data

Trends: Verified households replace vanity metrics

Tactics: How operators turn CTV into a profit channel (with benchmarks)

The Operator Playbook

Let’s dive in 👇

Macro Environment

📉 The $30B Paradox: A Boom Built on Broken Data

Connected TV is now the fastest-growing segment in digital advertising. U.S. ad spend is projected to reach $26–27 billion in 2025.

But here's what nobody wants to talk about: a massive chunk of that spend is being wasted.

According to industry benchmarks:

~20.8% of "CTV" impressions never reached a real screen. They were screensavers, mobile apps posing as CTV, or worse (Peer39, CTV Benchmarks Report).

Bot fraud accounts for 65% of all CTV fraud, the highest of any digital channel. (DoubleVerify, 2025).

25–40% of open-exchange CTV inventory passes through resellers, often recycling the same impressions multiple times and inflating CPMs through hidden intermediary fees.

As Dr. Augustine Fou of FouAnalytics puts it:

"CTV fraud doesn't come from bots. Smart refrigerators, python code on servers, and even javascript code in ad slots have been documented fabricating fake CTV bid requests by the hundreds of billions, pretending to be major CTV streaming apps. In CTV fraud, not only did the ads NOT run on a large-screen TV, the ads didn't run at all."

Why This Matters Now

CTV’s fragmented IDs and reseller-heavy paths make it hard to know where ads ran or who saw them, which is why the channel shows massive growth but low transparency.

For operators, that gap makes scale risky. The shift is toward household-level delivery and attribution tied to real revenue, not modeled reach.

🧠 Takeaway: CTV's growth curve means nothing without clean data. If you can't verify, you can't measure. And if you can't measure, you're not doing performance marketing, you're just buying reach and hoping.

Tactics

🛠️ Verified Households Replace Vanity Metrics

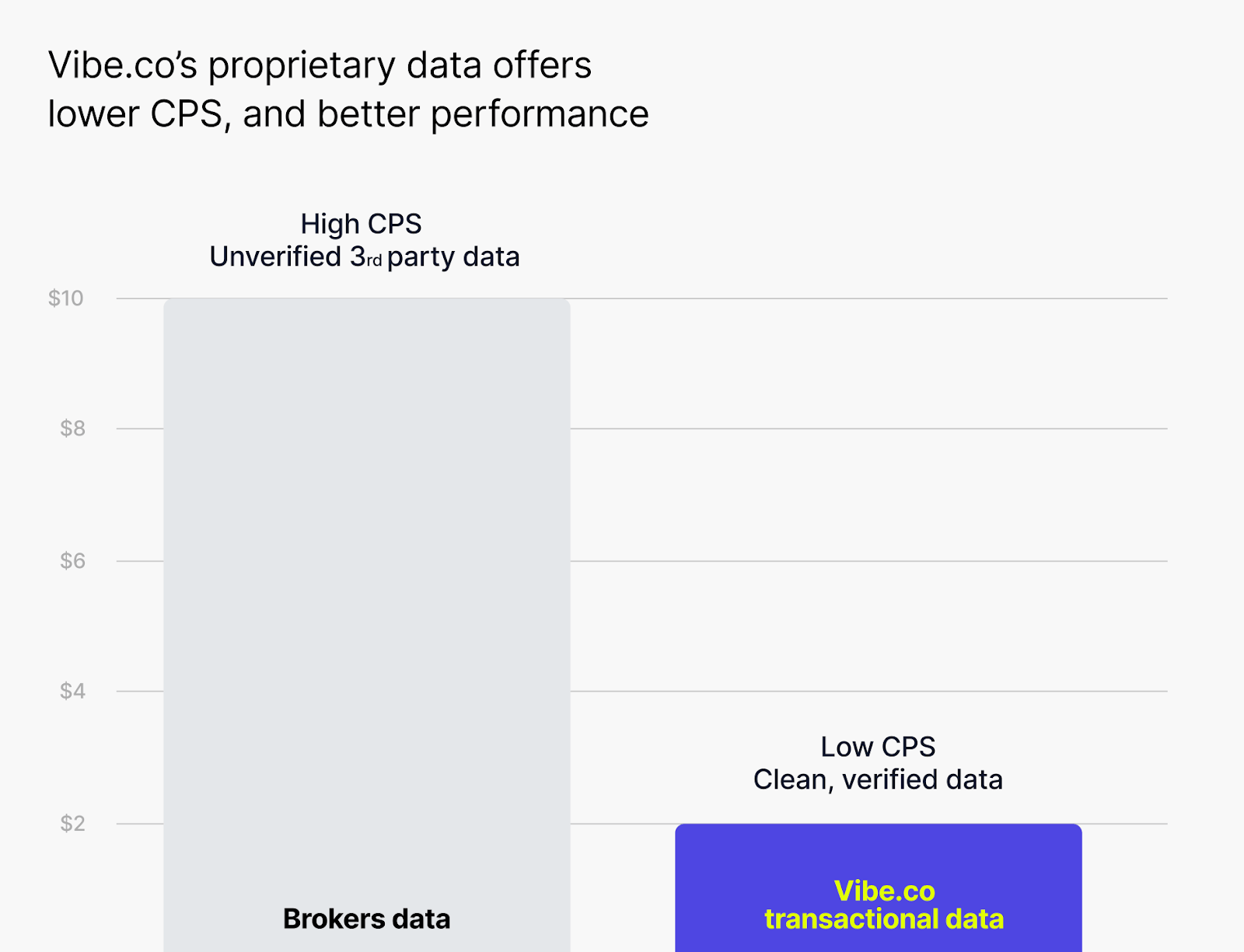

Open-exchange CTV was built for scale, not accuracy. Reseller chains inflate reach, device IDs get recycled, and attribution often depends on modeled estimates instead of real viewing behavior.

It’s volume without verification, which is why CTV looks strong in dashboards but weak in revenue.

Vibe takes the opposite approach. Their Certified Supply marketplace bans resellers entirely and authenticates every impression at the source, which eliminates the recycled, duplicate, and spoofed delivery that contaminates most open-market buys.

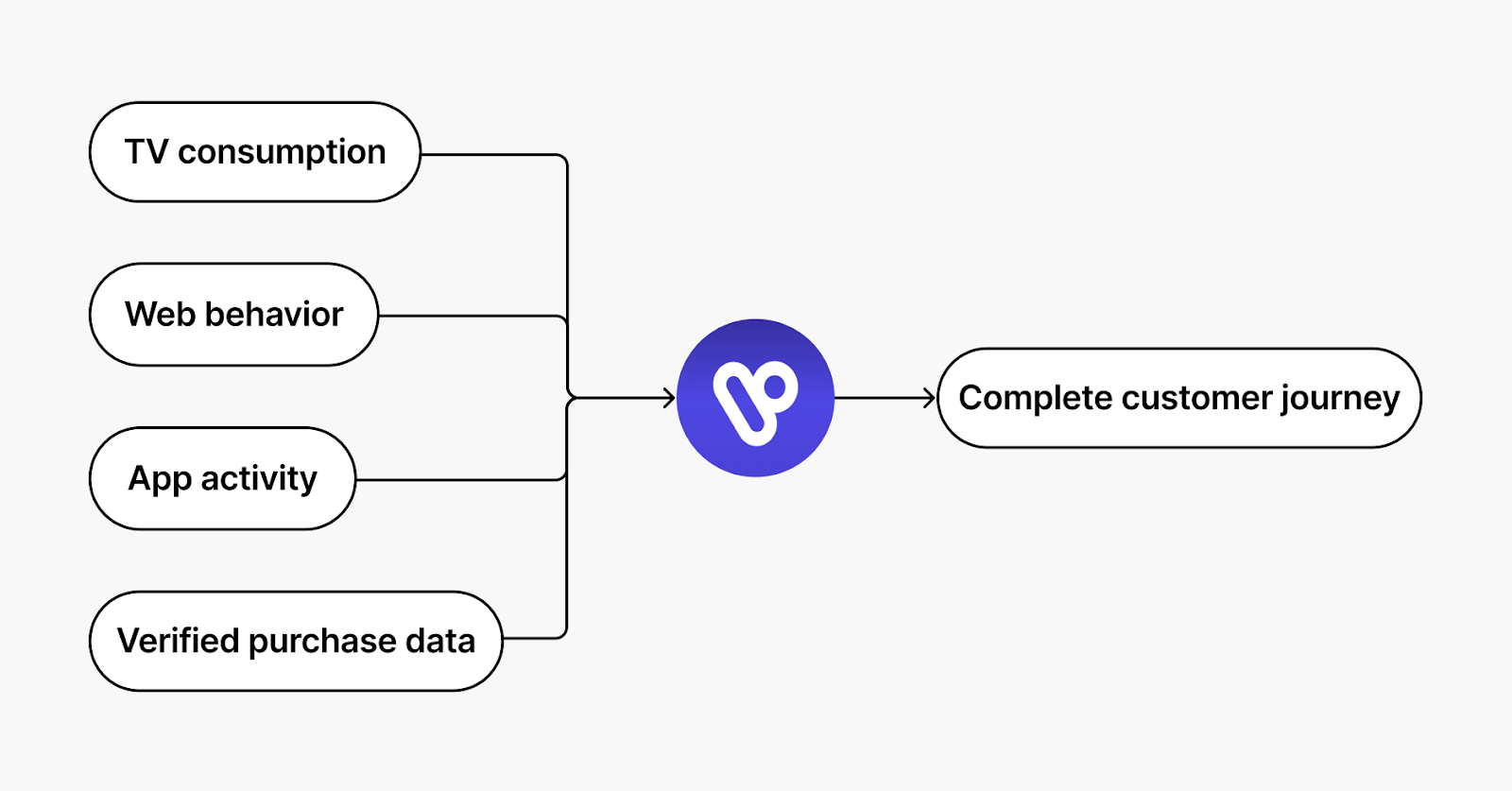

The breakthrough comes from verified identity: linking viewing, browsing, and transaction signals into a single, household-level profile. Vibe has authenticated over 80 million real viewer IDs, enabling targeting that behaves more like paid social:

High-AOV buyers from your CRM

Lookalikes based on purchase patterns

In-market shoppers showing real intent signals

This identity graph spans 500+ CTV apps and first-party commerce data for a full-funnel view.

And the reach is there.

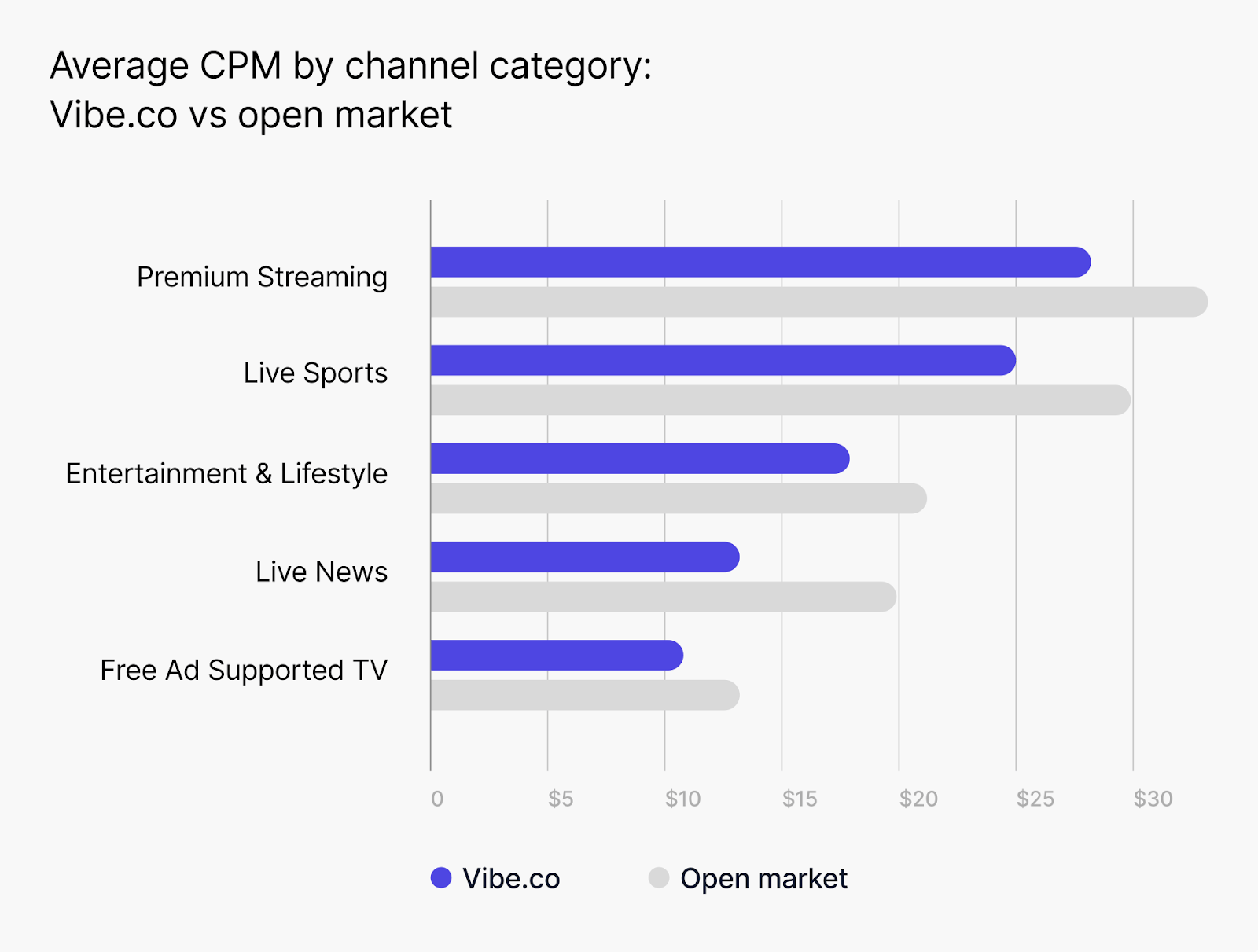

Smart TV usage is up 27% since 2021, and 90% of households own a CTV device. Verified supply cuts out duplicate impressions and intermediary markups, improving CPMs, match rates, and attribution, with many brands seeing up to 10X better performance.

For operators who want to see how this plays out across real campaigns, the Performance Playbook includes the identity maps and audience diagnostics that sit underneath these results.

🧠 Takeaway: The metric that matters is no longer "views." It's verified households tied to revenue. If your CTV partner can't prove the viewer is real, you're not buying performance, you're buying hope.

Trends

⚙️ How Operators Turn CTV into a Profit Channel

Now for the part that matters: how do you actually make money on CTV?

The answer comes down to three levers: hypertargeting precision, performance-grade creative, and transparent measurement.

Let's break down each.

1. Hypertargeting Precision: CRM Integration + Lookalikes

The fastest way to validate CTV is retargeting your existing audience through CRM data.

Vibe syncs directly with Klaviyo and HubSpot, so operators can activate CRM segments inside premium streaming environments within minutes.

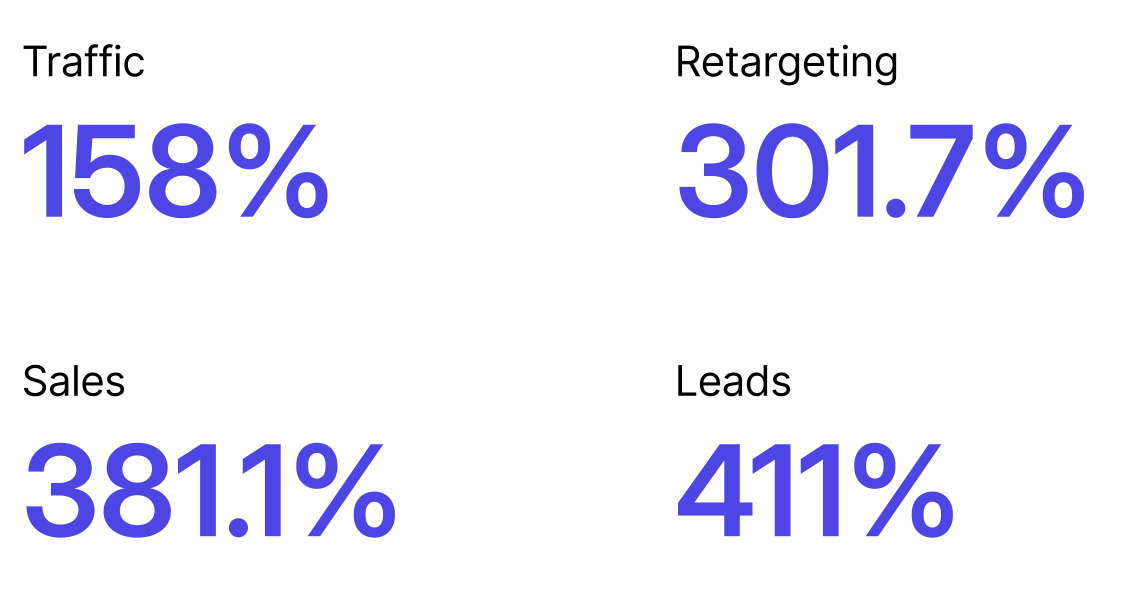

Over the past year, brands leveraging Klaviyo-integrated campaigns through Vibe.co achieved high ROAS across different campaign goals:

Real Results from CRM-Integrated Campaigns

Retargeting Benchmarks:

Sijo Home: +17% AOV, $0.33 CPS, 200% higher ad spend efficiency with lower CPA

Branded Bills: 311% ROAS at $0.33 CPS

Hoodsly: 409% ROAS

Sota Clothing: 312% ROAS at $0.41 CPS (Klaviyo + statewide awareness campaign)

Typical CTV Retargeting Benchmarks:

CPV (Cost per Verified View): $0.02–$0.04

CPS (Cost per Session): $0.33–$1.45

ROAS (Return on Ad Spend): 150–700%

Once retargeting is working, brands expand into lookalikes and intent-driven prospecting using purchase and browsing signals. A 40/60 retargeting-to-prospecting mix accelerates learning while staying efficient.

Operator tip: Segment by lifecycle. Creative and ROAS expectations vary dramatically between first-time buyers, subscribers, and repeat purchasers.

2. Creative Built for Performance TV

Targeting can’t fix bad creative. CTV isn’t social. Viewers are watching on large screens where clarity and pacing matter instantly.

The highest-performing CTV ads share 6 few core traits:

Emotional storytelling – Build connection before conversion

Clear, visible CTA – Spoken and on-screen

Authentic delivery – Real people, not overly scripted actors

Sound-off design – Over 60% of CTV impressions play at low volume; use captions and bold visuals

Strong branding – Sustained through color, tone, and audio

Single message – Avoid clutter or split attention

Where brands struggle is producing enough high-quality creative to keep up with CTV’s learning cycles.

Vibe.co’s Studio solves this by versioning and localizing assets automatically, cutting production costs by up to 80%. It tests formats, pacing, transitions, framing, and CTA variants, then pushes winners into live campaigns.

The result is faster iteration, less creative fatigue, and ads that are purpose-built for performance TV rather than repurposed social clips.

3. Measurement and Incrementality: Proving Every Dollar

Measurement is where most CTV breaks. Vibe.co uses a multi-layer attribution stack so operators can validate lift across independent systems instead of relying on in-platform dashboards.

The Multi-Layer Attribution Stack:

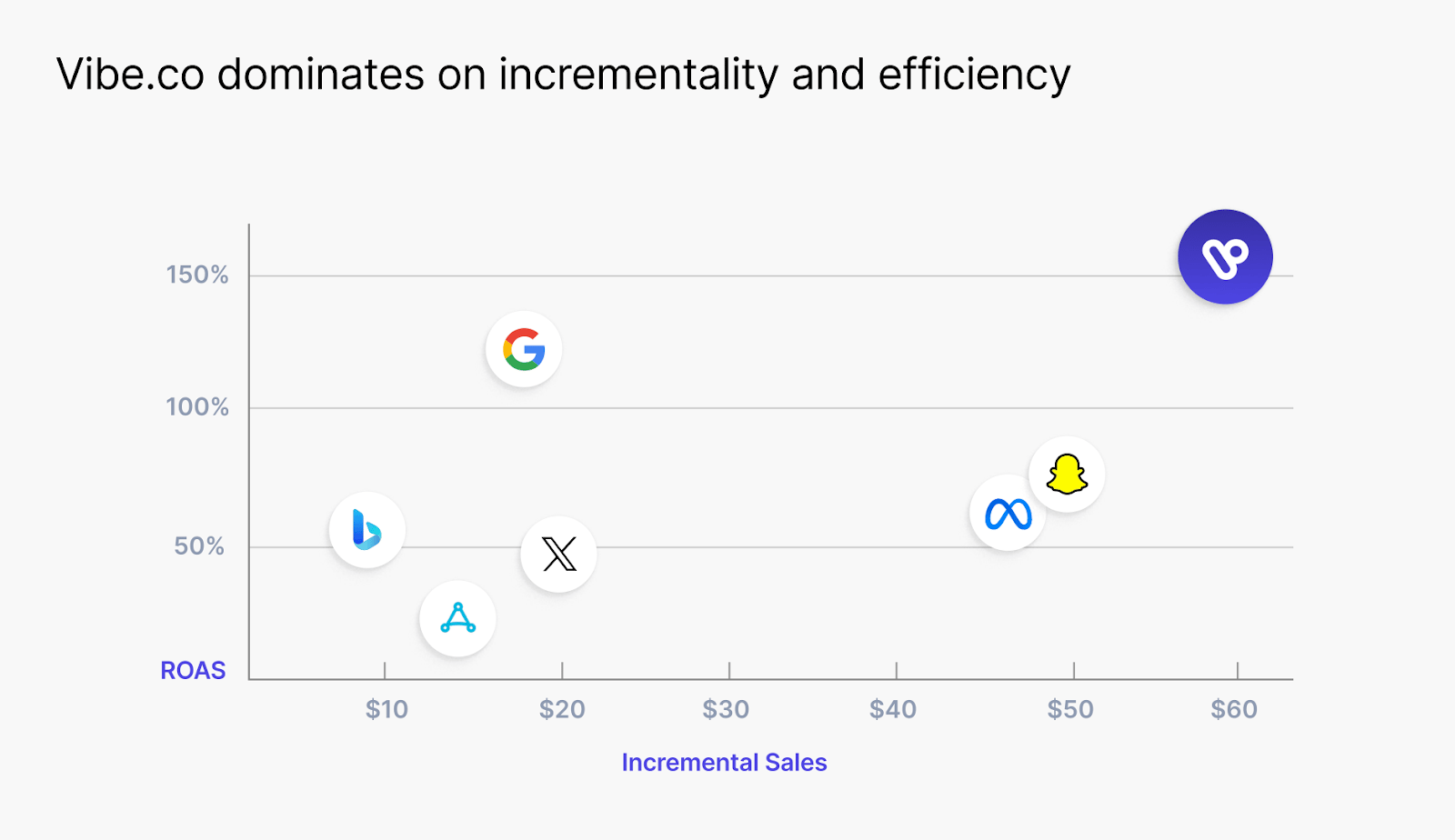

Across lift tests, verified CTV delivered $1.52 in incremental revenue for every $1 spent, with 6% of Shopify orders tied directly to CTV exposure.

In platform comparisons, Vibe.co outperformed Meta, Google, and Snapchat on incremental sales and ROAS efficiency.

You can triangulate performance across:

First-party pixel data (what actually happened after the ad ran)

Third-party MTA tools (how CTV fits into your full funnel)

MMM models (what revenue would not have happened without CTV)

When all three align, you get CFO-grade confidence in your CTV spend.

Trends

🎯 The Operator Playbook

If you're ready to test CTV as a performance channel, here's the phased approach:

Phase 1 (Weeks 1–4) Prove lift with CRM retargeting, a 40/60 retargeting-to-prospecting mix, and CPS/ROAS validation.

Phase 2 (Weeks 5–12): Scale what works by expanding lookalikes and testing creative variables in parallel.

Phase 3 (Month 4+): Build long-term efficiency through MMM validation, measurement triangulation, and ongoing creative iteration to prevent fatigue.

CTV is no longer a "test budget" channel. It's the next frontier for operators looking to diversify reach and find incremental growth beyond their core paid channels.

But only if you're buying real impressions, targeting real households, and measuring real outcomes.

🔗 Quick Hits

Explore the full Vibe 2026 CTV Performance Playbook for verified household data, real case studies, and frameworks that show how to turn CTV into measurable profit.

Reply