- The DTC Times

- Posts

- The End Of The Linear Funnel (And What Replaces It)

The End Of The Linear Funnel (And What Replaces It)

Everything you need to launch on AppLovin, why checkout is leaving your site, and what Sephora's doing with reviews

For years, the DTC playbook has been linear: drive traffic to your site, convince them to browse, get them to checkout. Discovery happened on one platform, research on another, and purchase on yours.

But today, that model is breaking down in real time.

AI agents are now handling the entire shopping journey—search, compare, checkout—without ever sending a customer to your site. Visual discovery platforms are transforming inspiration into instant purchase. And reviews aren't just validating products anymore; they're becoming the storefront itself.

This week, we're breaking down three forces reshaping how products get discovered and purchased, and what you need to do now to stay in control of your customer relationships.

Today:

🎯 Advertising Update: AppLovin Just Opened to All Brands → The invite-only ad platform is now accessible to all DTC brands

📉 Macro: ChatGPT Pushes Commerce Into the Checkout Agent Era → What happens when AI agents control discovery, recommendation, and purchase in one shot

📊 Trend: Pinterest’s Quiet Play for Gen Z’s Wallet → Why visual search is turning into an intent-rich acquisition channel

⚙️ Tactic: Sephora Shows Where Reviews Are Headed → The evolution of reviews into shoppable storefronts, and how to test it yourself.

⚡ Quick Hits → Nike x Skims, tariffs driving global expansion, DoorDash fulfillment, and OpenAI’s TikTok rival.

Let's get into it.

AppLovin is Now Open to All DTC Brands. Here's Everything You Need to Know.

The previous invite-only platform has officially dropped all access restrictions.

If you're not familiar: AppLovin places full-screen video ads inside mobile games. When players hit a natural break between levels, your ad takes over their entire screen for 35+ seconds.

No scrolling past. No competing with other ads in a feed. Just your product with locked attention.

Until yesterday, only a small group of brands had access, and they've been scaling hard:

Consistent 2-4x ROAS

80% same-day conversions

One beauty brand hit $1.2M in six weeks

Chew On This put together a complete resource guide with everything you need to launch without burning budget:

The full setup playbook (pixel, creative strategy, scaling)

Winning ad examples from DTC brands like Obvi

Video walkthroughs from founders already doing $100K+ months on the platform

Plus, there's a special offer for new brands: spend your first $5K, get $5K in ad credits. No GMV minimums. Open internationally (except Western Europe).

📉 Macro: ChatGPT Pushes Commerce Into the Checkout Agent Era

Checkout is leaving your website. OpenAI’s latest update lets shoppers search, compare, and purchase products from Shopify, Etsy, and others directly inside ChatGPT.

It’s more than a feature update, it collapses discovery, product selection, and checkout into one AI-mediated interaction.

But when an algorithm decides what to surface, the rules change.

Early signs suggest speed, price, and data clarity carry more weight than brand story. Fast shipping and clean metadata could matter more than your PDP design. That makes fulfillment and catalog hygiene as critical as creative.

The trade-off is clear: in this flow you lose email capture, upsells, and merchandising control. If your economics rely on list growth or bundling, that dependency becomes a risk.

What to do now:

Audit your presence. Test how your products appear in ChatGPT shopping flows. Are your listings surfaced? Are images, titles, and shipping times optimized?

Harden your direct channels. Invest in loyalty programs, SMS, and community touchpoints to keep ownership of customer relationships.

Strengthen structured data. Clear titles, rich product metadata, and consistent feeds aren’t just SEO — they’re how agents decide what to show.

Re-evaluate fulfillment promises. If AI is weighting delivery speed and reliability, your 3PL and shipping SLAs become a growth lever.

Takeaway: AI checkout collapses discovery and purchase into a single moment. The brands that adapt their feeds, fulfillment, and owned channels will hold leverage as the gatekeepers shift.

📊 Trends: Pinterest’s Quiet Play for Gen Z’s Wallet

Pinterest is steadily moving from inspiration board to shopping engine.

With “where-to-buy” links and local inventory ads, users can now go from idea to purchase in a few taps (Retail Brew).

This is powerful for Gen Z. They don’t always search with keywords, they recognize what they want when they see it.

Pinterest leans into that behavior with algorithms built for visual recognition, not viral trends.

Why this matters for operators:

Higher intent signals. A pin tagged “fall boots” is closer to purchase than a TikTok that happens to feature boots.

Inventory-driven discovery. With local feeds, in-stock status becomes a differentiator. That means feed hygiene and inventory syncing are as important here as on Amazon.

Algorithmic edge. Pinterest’s recommendation system is built for visual recognition, not viral content, which reduces volatility and offers steadier acquisition.

What you can do to stay ahead:

Sync your product feeds and test how your catalog appears in Pinterest search

Tailor creative to match Pinterest’s native aesthetic (clean, aspirational, visual)

Treat attribution seriously: test how Pinterest contributes to assisted conversions in your funnel

Takeaway: Pinterest isn’t the flashiest platform, but it’s becoming a reliable acquisition lever in categories like fashion, beauty, and home. If you’ve deprioritized it, this is the moment to test it seriously.

⚙️ Tactics: Sephora Shows Where Reviews Are Headed

Think about the evolution of reviews in DTC: first it was star ratings, then UGC photos, then affiliate links.

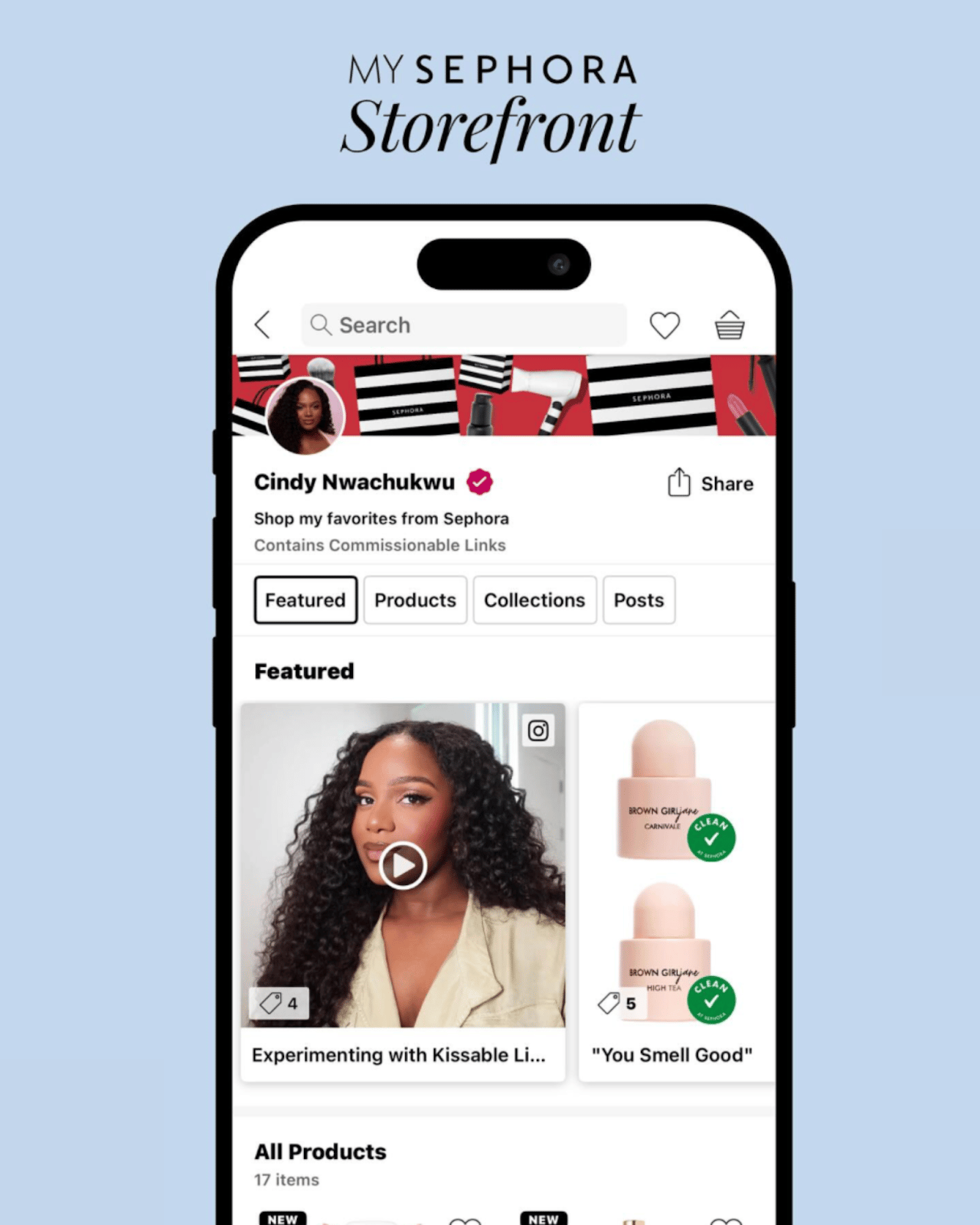

Sephora’s new My Sephora Storefront is the next step; turning reviews into curated shops that live directly inside the platform. Creators can assemble collections, push them to their audiences, and earn on the transactions that happen without leaving Sephora’s ecosystem.

The bigger story isn’t Sephora. It’s what this means for the role of reviews in commerce.

They’re no longer about validating a purchase, they’re starting to drive the purchase. And once that line blurs, platforms will double down on making every piece of review content shoppable.

For operators, that creates both opportunity and risk:

Opportunity: Reviews can be packaged as curated bundles, seasonal collections, or even exclusive drops. A review becomes a distribution channel, not just a conversion nudge.

Risk: If you don’t build your own version of this, someone else will own that layer of the funnel. And if commissions aren’t managed carefully, margins erode quickly.

The play isn’t to copy Sephora outright. It’s to test where your reviews and creator partnerships can evolve into storefronts on your own turf.

Operator playbook (how you test this in your stack)

Pilot mini-shops or “creator collections” on your owned site. Offer a small set of SKUs curated, packaged, and sold via creator aesthetic. Use this as a benchmark for conversion lift vs. standard affiliate links.

Apply margin filters. Only push SKUs with healthy repeat rates, retention, or margin room (so creator cut doesn’t kill your economics).

Track deep metrics. Go beyond revenue. Look at returns, repeat purchases, LTV of those orders, and cross-sell rates.

Align catalog + storytelling. Make sure the product metadata, images, and bundles are creator-friendly — they should be as easy to pitch as they are to buy.

Consider exclusives or early drops via creator shops. Reward creators with early access or exclusive picks that help them differentiate their storefronts.

Takeaway: Sephora is transforming the “review” role into a commerce tool. The write-ups are becoming storefronts. Brands that preemptively enable creator commerce paths (rather than chasing it reactively) will capture both trust and margin.

⚡ Quick Hits

Nike + Skims join forces in activewear — Nike and Skims are launching a women’s activewear brand this Friday, combining Nike’s distribution with Skims’ cultural cachet. A signal that collabs between legacy performance giants and celebrity-led DTCs are becoming the new growth lever.

Tariffs push brands abroad — Facing rising costs, some brands are pulling back from U.S. expansion and focusing on international markets instead.

DoorDash expands into fulfillment — DoorDash announced DashMart Fulfillment Services, offering warehousing and same-day delivery for retailers. Another sign that “instant” logistics networks are moving into traditional 3PL territory.

OpenAI to launch Sora, its TikTok rival — OpenAI debuted Sora, a TikTok-style app for sharing AI-generated videos powered by its new Sora 2 model. Another platform entering the mix where content, discovery, and distribution converge.

Reply